by Laura Waldrop | Dec 14, 2023 | Accounting, Budgets, Business-Building, QuickBooks, Tax, Uncategorized

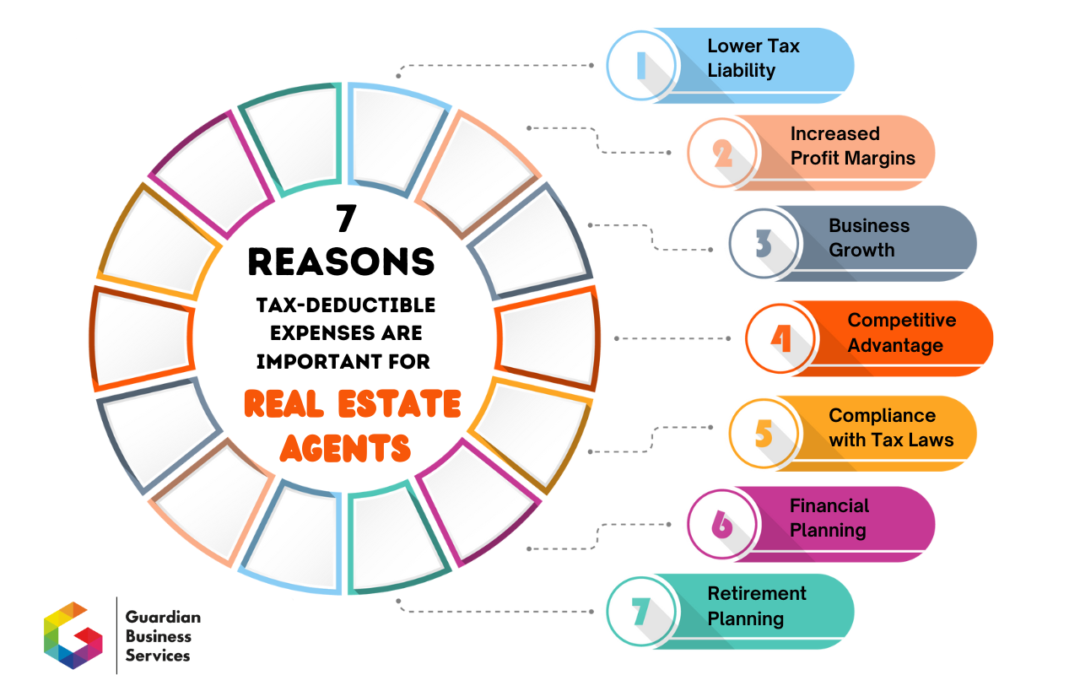

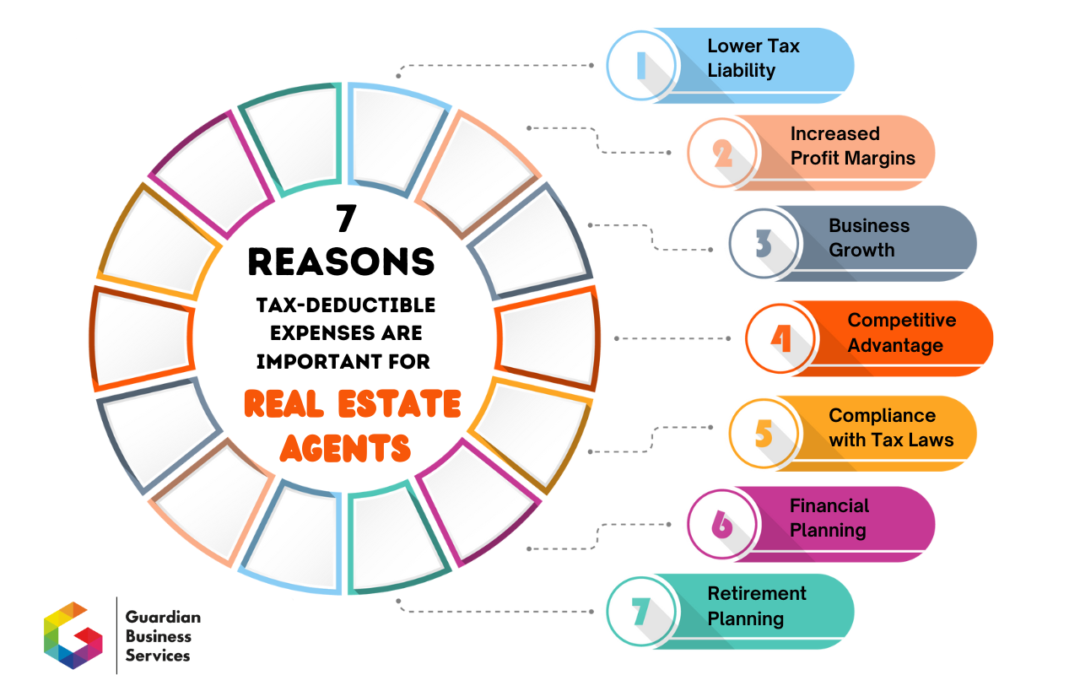

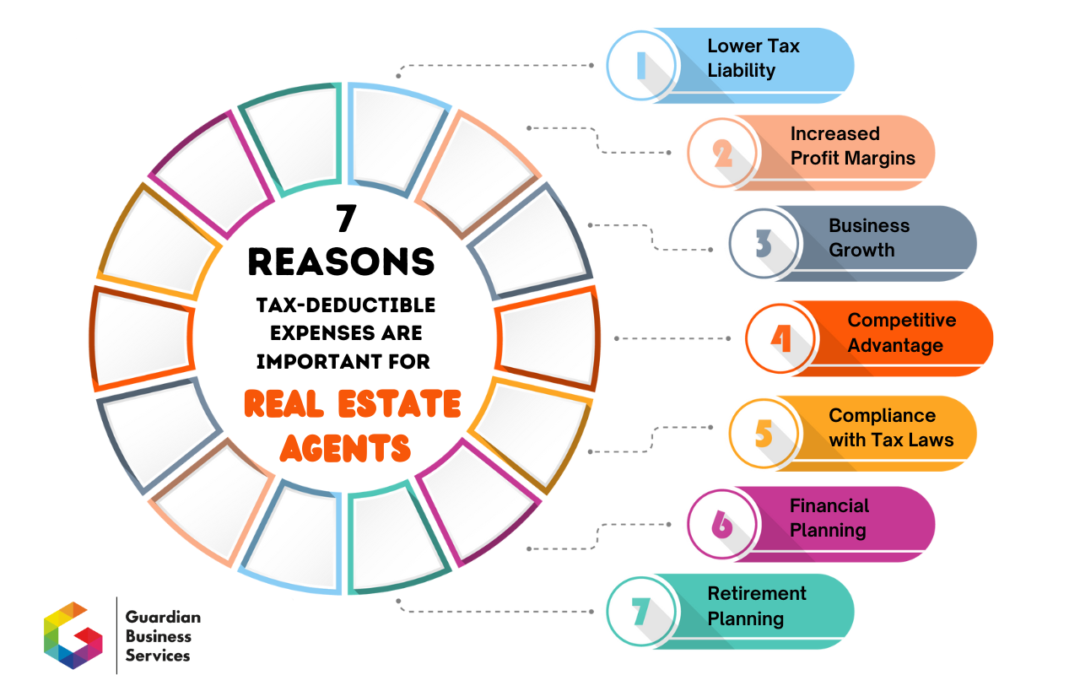

Tax-deductible expenses for real estate agents is such an important area for their sales business. Knowing how and what to deduct can help reduce taxable income and ultimately lower the amount of income tax owed to the government. Everyone wants that, right?! Real...

by Laura Waldrop | Dec 7, 2023 | Budgets, Business-Building, QuickBooks, Tax, Uncategorized

You probably didn’t know that many celebrities got their start in accounting, and that many accountants made the history books. As you’ll see from these fun facts, accounting can inspire you, turn you into an author, make chart-topping hits, and help to put mobsters...

by Laura Waldrop | Nov 30, 2023 | Budgets, Business-Building, QuickBooks, Tax, Uncategorized

A profit and loss statement, often called an income statement or P&L for short, serves as a powerful tool for gaining crucial financial insights. This tool empowers you to make informed decisions, allocate resources efficiently, and track your journey toward...

by Laura Waldrop | Jan 24, 2021 | Accounting, Business-Building, QuickBooks

A glance in your financial rearview mirror often looks good for you as a real estate agent: You met your gross commission income (CGI) goal, you closed several good deals, and, most importantly, your business is still alive and well. But is it thriving or merely...