by Laura Waldrop | Dec 14, 2023 | Accounting, Budgets, Business-Building, QuickBooks, Tax, Uncategorized

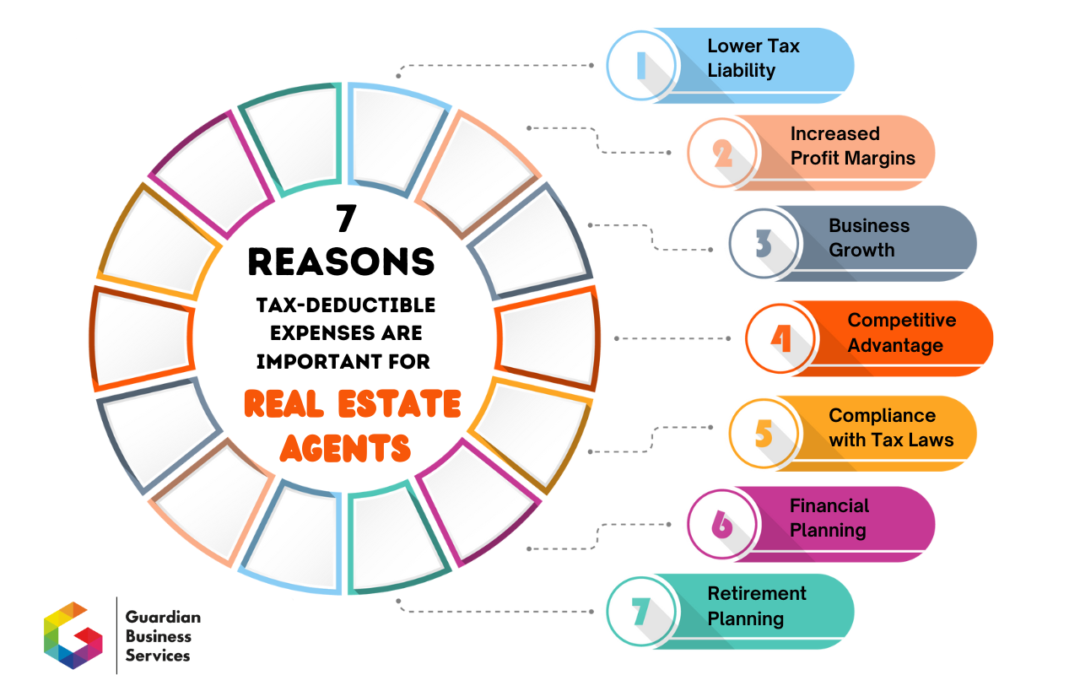

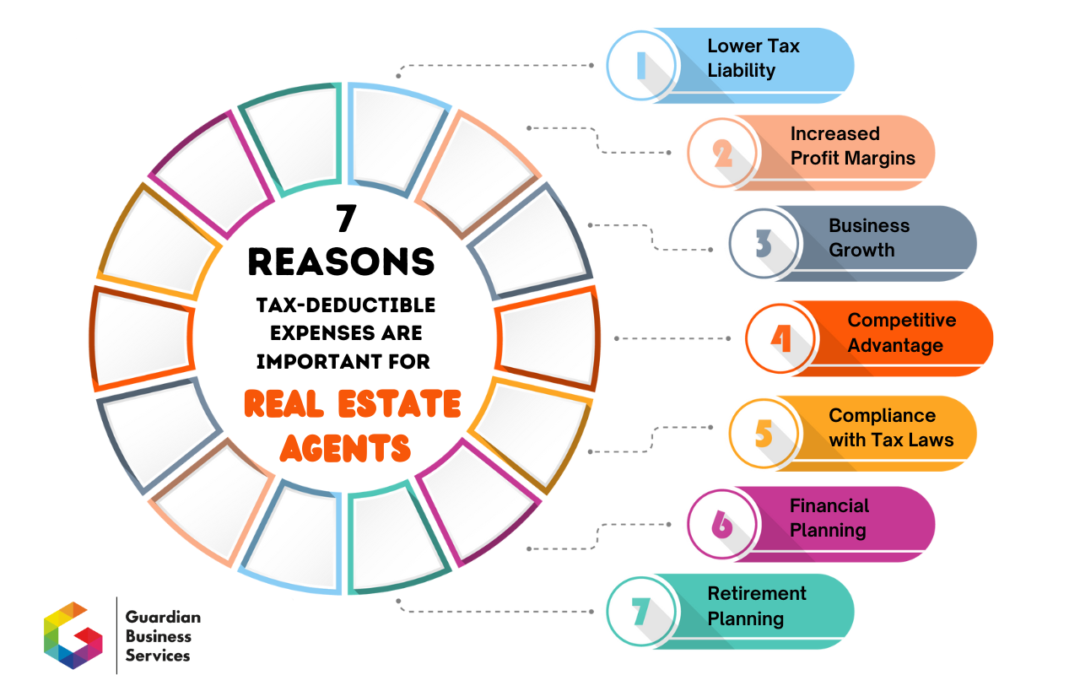

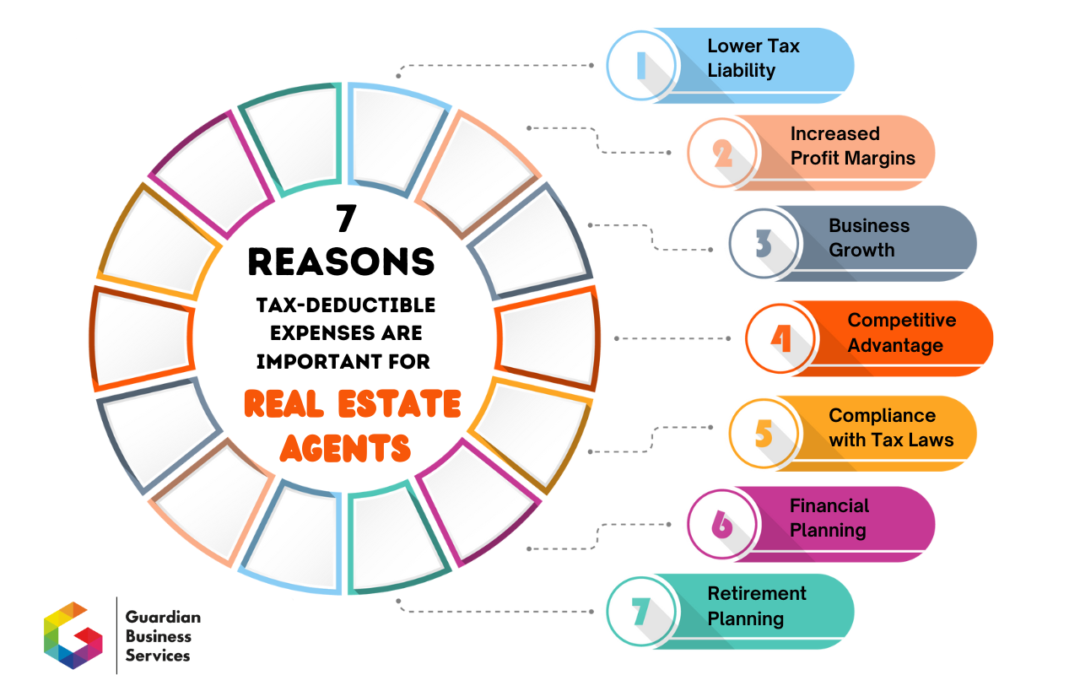

Tax-deductible expenses for real estate agents is such an important area for their sales business. Knowing how and what to deduct can help reduce taxable income and ultimately lower the amount of income tax owed to the government. Everyone wants that, right?! Real...

by Laura Waldrop | Dec 7, 2023 | Budgets, Business-Building, QuickBooks, Tax, Uncategorized

You probably didn’t know that many celebrities got their start in accounting, and that many accountants made the history books. As you’ll see from these fun facts, accounting can inspire you, turn you into an author, make chart-topping hits, and help to put mobsters...

by Laura Waldrop | Nov 30, 2023 | Budgets, Business-Building, QuickBooks, Tax, Uncategorized

A profit and loss statement, often called an income statement or P&L for short, serves as a powerful tool for gaining crucial financial insights. This tool empowers you to make informed decisions, allocate resources efficiently, and track your journey toward...

by Laura Waldrop | Apr 23, 2021 | Budgets, Business-Building, QuickBooks, Tax, Uncategorized

The Benefits of Paying Estimated Quarterly Taxes and How to Calculate Them While there are no criminal penalties for not paying your real estate business’ taxes every quarter, there are distinct advantages for doing so. You can save considerable money—and avoid...

by Laura Waldrop | Mar 24, 2021 | QuickBooks, Tax

COVID-19 has taken a financial toll, and the recovery process is in full swing. To give Americans a little push in the right direction, the U.S. government and the IRS are adjusting several deductions, most of which will help you keep a little extra money in your...

by Laura Waldrop | Oct 25, 2017 | Tax

You know that at the close of each month, you need to complete a month-end report to keep your accounting statements updated. You also have to issue a yearend report and mail out IRS Form 1099s to vendors for their taxes. There are a lot of issues you have to address:...