Be Compliant with BOI Reporting by the Deadline in a Few Simple Steps!

If you have determined that you need to comply with the new BOI reporting obligation (ATTENTION all real estate agents with LLCs!), here is a short guide explaining how to do it in a few simple steps! It is FREE and QUICK to do online. For a refresher on the new BOI...

6 Tax-Planning Strategies to Implement Before Year-End

Are you ready for tax time? Did you know that most tax-planning strategies need to be implemented before year-end? Instead of pushing your tax preparation until after the holidays, consider taking a proactive approach to maximize your savings. In this article, we’ll...

Lowering Your Tax Bill: Deductions vs. Credits

Did you have a great year in real estate? First off, congratulations! Finally seeing all of your hard work pay off is exciting. However, before you go purchase your “treat yourself” gift, you need to think about tax time. Following the generic rule to save 30%...

Understanding the New Beneficial Ownership Information Report

Is your real estate business currently operating under a limited liability company (LLC)? If so, are you aware of the annual Beneficial Ownership Information (BOI) report? This added filing obligation applies to all agents with LLCs, regardless of whether you are a...

Tax-Time Prep: What You Need to Know About 1099s

If you are a business owner, you are most likely familiar with receiving various 1099s each year. However, did you know that you might actually need to issue 1099s to contractors and other individuals who perform services for you? For example, if you're a real...

Everything You Need to Know About Accountable Plans

Do you frequently pay for business expenses out-of-pocket? Does your business reimburse for mileage? Is your business structured in a way that you can’t claim the home office deduction? If either of these situations applies to you, it might be time to consider...

6 Ways Your Personal Goals Are Tied to Your Financial Stability and Savings

When "personal goals" comes to mind, you may already know that being financially stable and having some savings are important, but you may not know exactly how much of an impact they have on all aspects of your life. Here are 6 ways your personal goals are tied to...

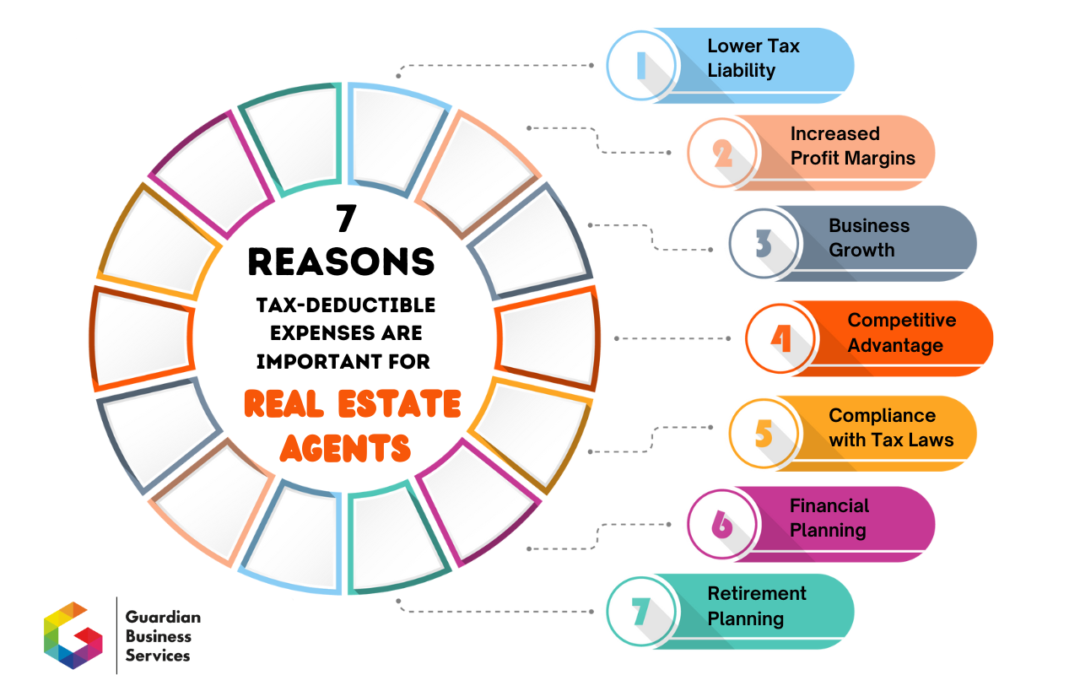

Tax-Deductible Expenses for Real Estate Agents

Tax-deductible expenses for real estate agents is such an important area for their sales business. Knowing how and what to deduct can help reduce taxable income and ultimately lower the amount of income tax owed to the government. Everyone wants that, right?! Real...

Accounting Fun Facts? Yes!

You probably didn’t know that many celebrities got their start in accounting, and that many accountants made the history books. As you’ll see from these fun facts, accounting can inspire you, turn you into an author, make chart-topping hits, and help to put mobsters...

How does having a profit and loss statement help me achieve my personal and professional goals?

A profit and loss statement empowers you to make informed decisions, allocate resources efficiently, and track your journey toward personal and professional goals.