Creating a budget will help your real estate business succeed and allow you to continue to benefit personally through that success. Robert Kiyosaki once said, “It’s not how much money you make, but how much money you keep, how hard it works for you, and how many generations you keep it for.”

The profit you gain from your business can only be of use to you and your family if you manage expenses correctly. Having a set budget is the best way to achieve that goal.

Benefits of Making a Budget

Budgeting allows you to track your everyday spending habits and see where you can make improvements. It will help you see an overall picture of your expenses and therefore guide you in the best way to increase business profit and personal savings. Here are a few ways you can benefit from making a budget.

- Save money: Set up to transfer a portion of your income to your savings account every month.

- Eliminate overspending: Categorize where you’re spending to help keep your money in the right places and generate the highest return on investment.

- Achieve financial goals: Have a set monthly amount put toward paying off a debt or saving for a specific item.

- Stay in control: Check your budget regularly and keep track of where you are compared to your monthly and annual goals. Seeing your budget vs. actual money spent will help you stay in control.

- Fewer money concerns: Create good bookkeeping habits by laying out easily accessible categories so you can quickly see where you are financially and make adjustments when needed.

How to Make a Budget

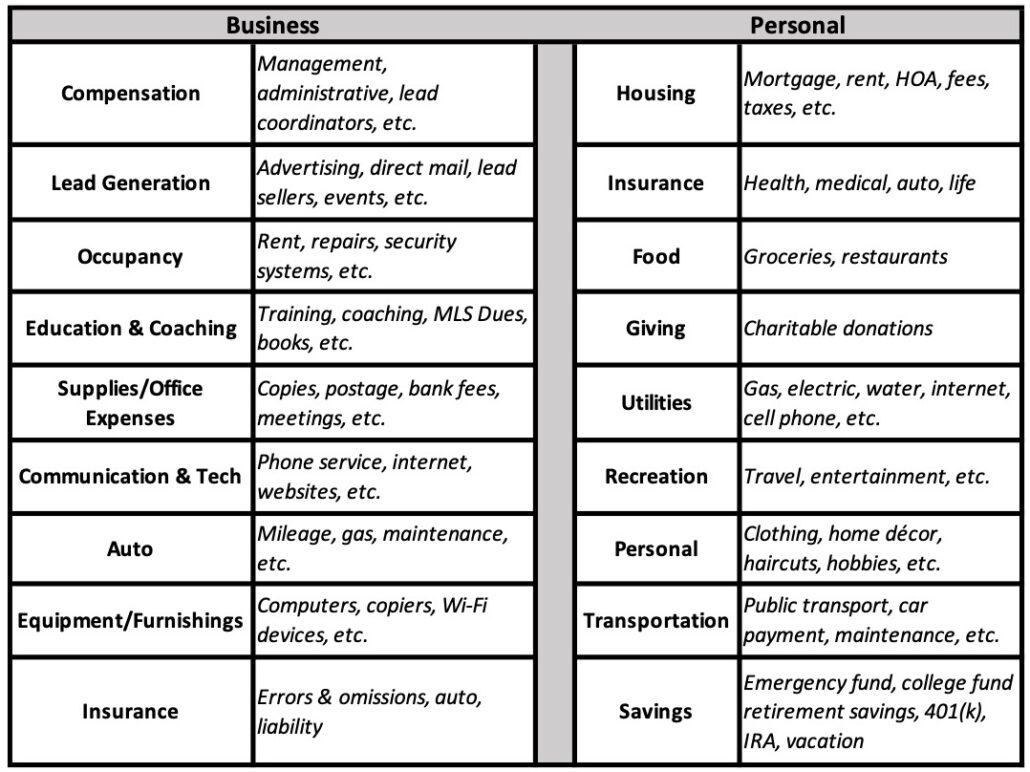

The process of setting up a budget is simply, as Dave Ramsey stated, “telling your money where to go.” This means setting up categories for your business and personal accounts that correspond with your lifestyle and then calculating your expenses in each of those areas.

You will gain the necessary big picture to see exactly how much money you are currently spending, where you are spending it, and what adjustments you need to make your money work better for your business and your family. A few categories you may set up could include:

What’s Next?

“Money, like emotions, is something you must control to keep your life on the right track.” – Natasha Munson

Making a budget may seem overwhelming, but the benefits far outweigh the time it takes to create one. Once it is set up and organized, adding expenses or new categories is simple. A professional bookkeeper can guide you through figuring out exactly where to put your money and then keep track of your spending and the flow of your income. They will let you know how successful you have been or what adjustments may be needed every month. Managing your expenses with a budget will provide you with the tools to make your real estate business succeed and keep you and your family thriving financially.